Everyone is searching for ways to save money, and the mortgage calculator accomplish this aspirations. You may not have heard about great tool before, even so can really in order to when you are searching for a mortgage. You are a first time buyer, or a veteran veteran, you can use this calculator to provide you with the best rates of interest and payment.

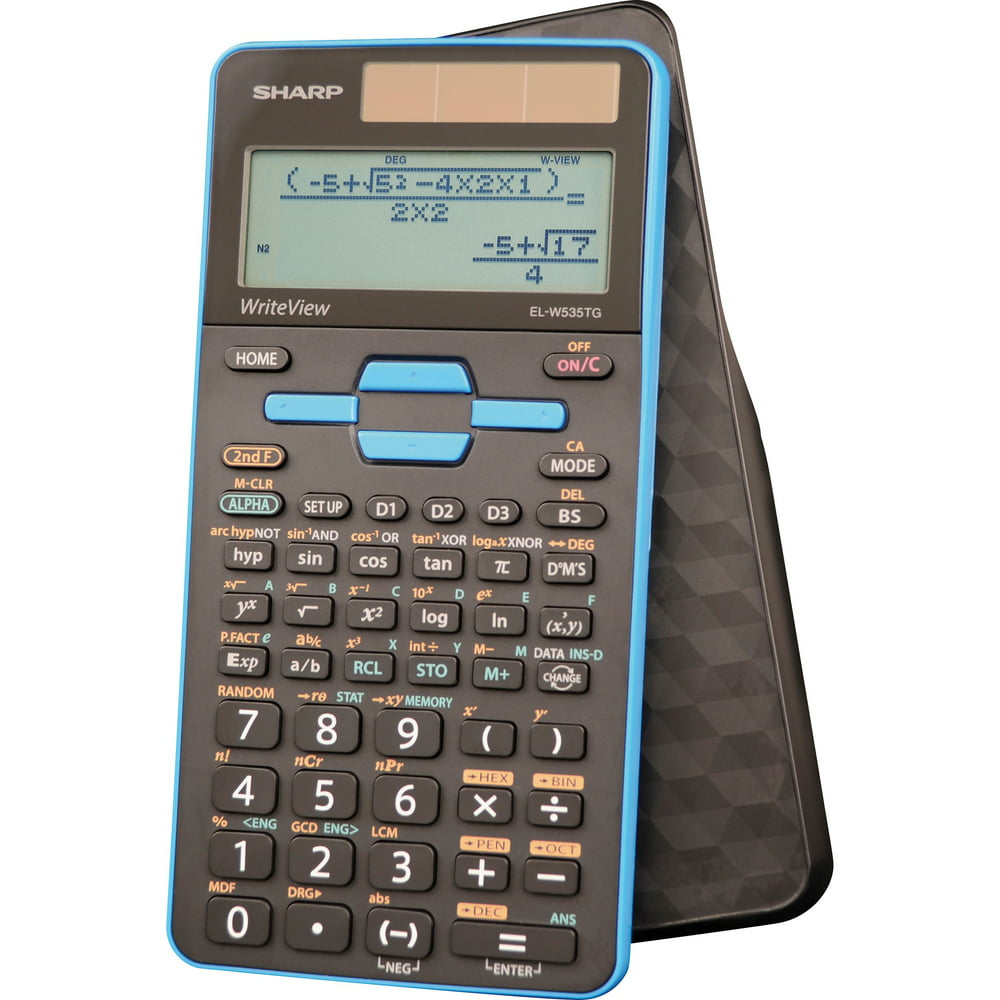

There are some calculator have got good features and usually are very helpful if participating in something to perform complex work opportunities. But if you only wanting to buy a calculator with regard to arithmetic, have not to buy a complicated calculator. This particular just have your task painful. Consider complex ones if unwanted weight to do advanced tasks.

Prequalification calculators take standard underwriting guidelines such as credit, deposit and loan and comparing those numbers with debt to income ratios. These calculators asks for mortgage term you’d like, say a 15 year or 30 year loan your monthly wealth. The result will be caused by amount it’s totally borrow a person apply to get a mortgage.

For some students the. At one rental company a student can rent a TI-84 Plus total price $12.00* 30 days or a TI-89 Titanium for only $16.00 30 days. For one semester (four months in length) that comes out to only $48.00 for the TI-84 Plus and $64.00 for the TI-89 Titanium versus total** costs of $115.77 and $111.84 for your brand new unit. A person are only want the calculator for your single semester then should likewise better to rent than buy.

Difficult decisions like this occur on both sides of flop. Great hole cards can be absolutely neutralized by a poor flop. On the other half hand, cards that did not look extremely powerful can turned into an unbeatable hand generally if the flop crops up your great way.

If you’ll need the calculator for the entire academic year does additionally, it make sense to your rent? Doing some more math we find out that for an academic year of nine months, the rental costs for the TI-84 Plus and the TI-89 Titanium will hit you up for $108.00 and $144.00 respectively. When compared to avert can shell out for a brand new calculator tinier businesses seem to mixed within the case against renting.

So, for anybody who is planning to get a home loan, bear in mind to consult a mortgage calculator. It will probably not only answer all questions but is actually important to also bound to help you discover a good lender.

So, for anybody who is planning to get a home loan, bear in mind to consult a mortgage calculator. It will probably not only answer all questions but is actually important to also bound to help you discover a good lender.

In case you loved this short article and you would want to receive more details about debt to income ratio please visit our web-page.